Adapting to the New Normal

The COVID-19 has unquestionably taken its toll on all industries verticals. Moreover, the full impact is yet to understand. Most businesses had to adapt to the growing circumstances on the go. While the initial spikes and slumps are analyzed, we’ll evaluate some of the great market players that have adapted to the new norms during the pandemic. One of the leading traffic analysis tools has gathered market data on several industry verticals that showed atypical increase or decrease in online presence during the past few months. The data contains the report of June-August 2020 traffic numbers against March-May 2020.

The report contains a few key findings, like:

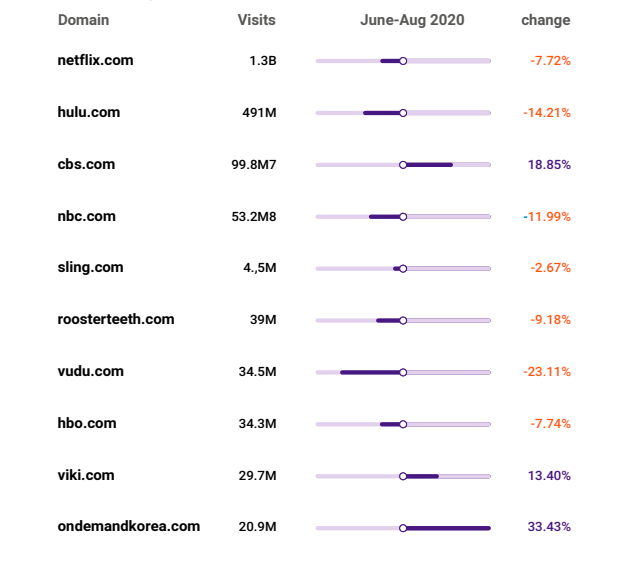

- Netflix is a perfect pandemic champion, but even its growth is now decreasing

- Only 3 product categories have a 50% increase in customer interest

- A 20% drop in demand for teamwork applications, and more

Work From Home Impact: Teamwork, Webinars & Money Transfer Platforms

With a large portion of the population imposed to turn their houses into work stations, the simple initial growth of platforms that facilitate the work-from-home status seems to be over. With the decreasing traffic numbers, it’s not shocking to see the stock price growth of public companies slowing down.

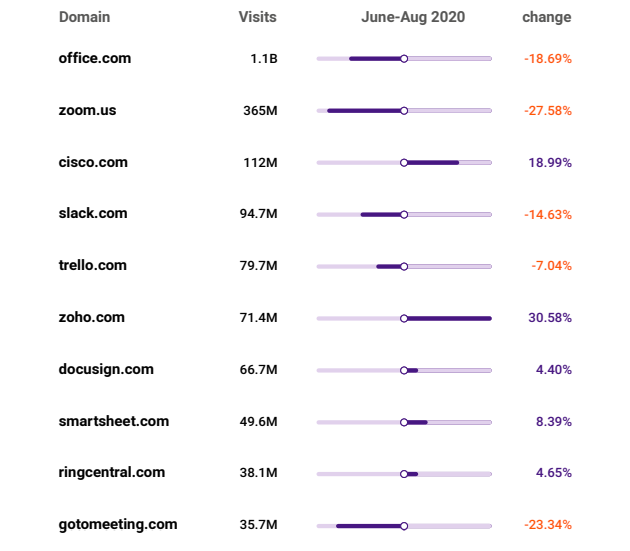

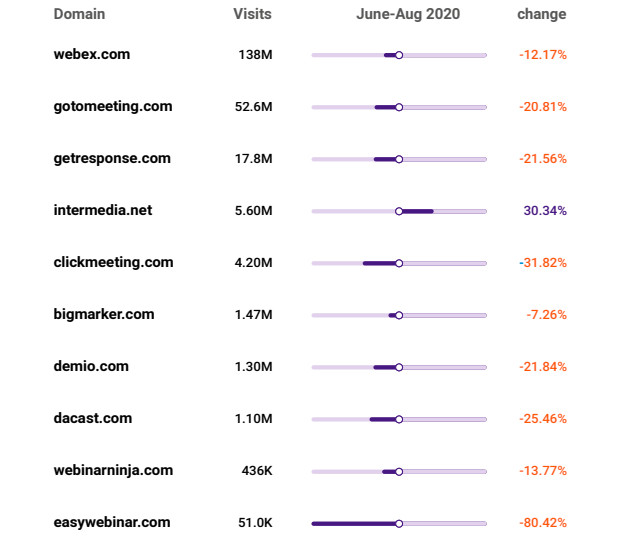

As economies started to reopen worldwide, most of the people are moving back to their offices. So, there is a slight decline in the demand for teamwork and webinar (by 3% to 20%).

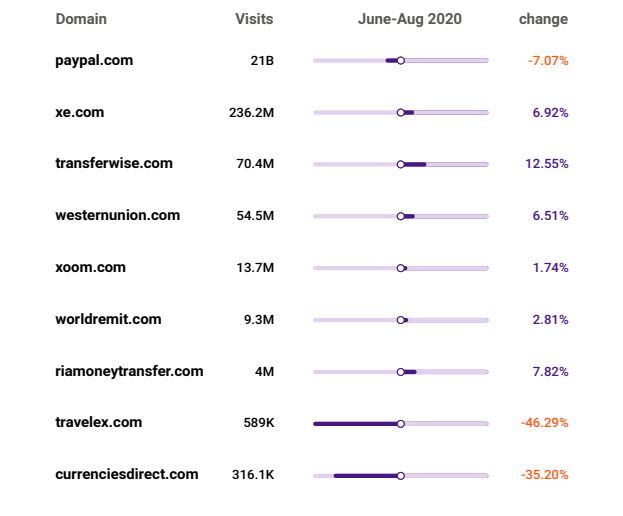

A few of the webinar platforms like Clickmeeting, Easywebinar, and Getresponse are even seeing a decline in the traffic number. Another market category showing an enhanced growth rate at the start of the COVID-19 pandemic was Money Transfer Services (MTS). Therefore, interest in teamwork and webinar platforms is gradually decreasing, but most of the money transfer industries seem to be able to manage growth.

Online Shopping Behavior Impact

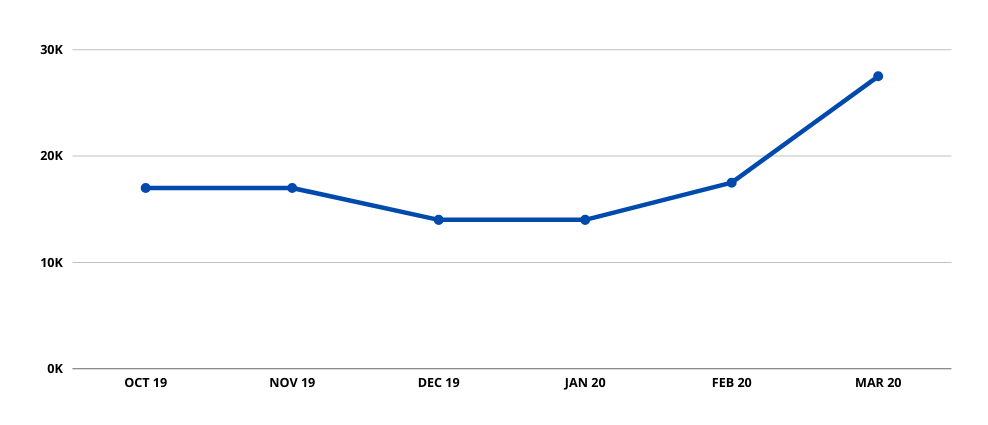

At the start of the COVID-19 pandemic, we observed some incredible spikes for online shopping interest:

But the customer demand for online shopping from general retailers is now gradually decreasing as most of the businesses have started resuming their brick-and-mortar facilities. Moreover, most of the Government-initiated financial considerations to maintain shoppers’ beliefs have ended.

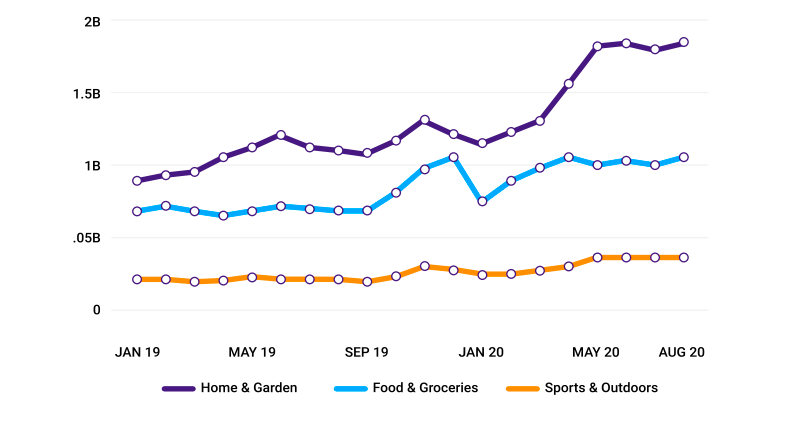

Due to Work from home, the three product categories that displayed the highest traffic growth rates with a 40-50% boost in demand are Home & Garden, Food & Groceries, and Sport & Outdoors.

Customer Demand Result: Education vs. Online Entertainment Platforms

With the increase in the overall content utilization during the COVID-19 pandemic, some markets have shown greater flexibility than others. Furthermore, offline enjoyment was on hold, and online alternatives walked in. And online streaming and movies are great examples of alternative methods.

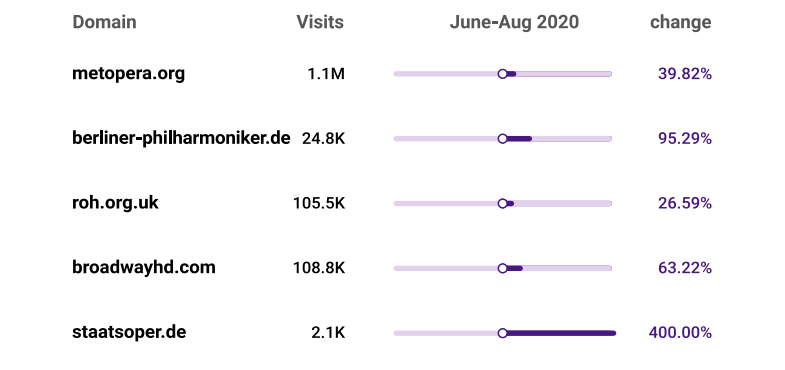

Moreover, we see that opera theatres have done a great job of adjusting to the current pandemic situation and drawing their offline customers to see live streams instead.

But of course, streaming platforms have topped the chart when it comes to increased customer demand. With the March-May 2020 traffic doubling and quadrupling, the June-August traffics are too weak to claim that streaming platforms’ growth during the pandemic has been overestimated.

On top of enjoyment or entertainment, while at home, people also hurried to education platforms like Udemy and Khan Academy to acquire new skills or enhance their existing skills. Yet by August 2020, most of the educational platform seems to be getting back to pre-pandemic traffic levels, with only a few educational platforms like Coursera and EdX being able to support the new audience.

Executing Competitor Analysis in Random Times

Not all industries verticals have been as successful at remodeling their digital marketing strategies to improve their online presence at difficult times when moving online is the only way to stay ahead of competitors. Businesses can navigate through the possibilities by following the three crucial competitor analysis steps:

#1. Discover the Threatening Market Players

Doing competitor analysis during random times using various competitor analysis tools will help to understand online strategies to catch up with your biggest market rival. You will get the insights provided for the entire market section by considering how brands stand against each other in terms of customer size and increase in traffic.

Amazon, an eCommerce giant, has the highest traffic share among other online retailers and is increasing at higher rates than the niche market players. Moreover, in digital terms, traffic implies market share and potential audiences, which makes Amazon the most threatening brand for other online stores.

#2 Uncover Traffic Acquisition Strategies of Rivals

Having no access to competitor’s internal traffic data, most of the online stores could use traffic analytics tools for more data. Traffic analytics shows how the competitor prioritizes its traffic acquisition strategies. Based on competitor’s insights, you can make some assessments about the potential customers across various platforms and adjust its traffic creation efforts.

#3. Seize the show with an Ad Strategy

While competing with competitors’ traffic acquisition strategy, there are a few hidden tricks you could apply to compete for a huge audience share. If your competitor has the highest unique number of visitors, then you could capitalize on that target audience and reach them precisely on the platforms they visit most regularly. You can achieve this by targeting them using remarketing campaigns on related platforms.